Author: Abigail Sexton

High Point FCU brings Bite of Reality to Olean High School

January 14th, 2026 – Olean, NY. High Point Federal Credit Union staff shared their new Bite of Reality financial education program with Olean High School, with nearly 50 seniors participating. Bite of Reality is a modern, app-based simulation that gives students hands-on experience managing personal finances in real-world scenarios.

High Point FCU originally implemented the Mad City Money program in 2013, presenting it at Olean and Allegany high schools. Today, the Credit Union has transitioned to Bite of Reality, an updated version of the same concept delivered through an interactive mobile app. The program continues to provide students with a realistic look at adult financial responsibilities while leveraging technology to enhance engagement and accessibility.

Through Bite of Reality, students begin by selecting an assigned “identity,” which includes an occupation, salary, family status, student loan and credit card debt, and insurance expenses. Using the app, participants make financial decisions related to housing, transportation, childcare, food, and other necessities, all while working to stay within their assigned budget.

Students learn how to manage monthly expenses, understand credit card payments, handle unexpected financial challenges and windfalls, and evaluate how lifestyle choices impact their financial stability. While some students are able to save money by the end of the simulation, others must revisit decisions and make more affordable choices, mirroring real-life financial tradeoffs.

When asked about the main takeaways, students shared a greater appreciation for their parents’ spending decisions, a clearer understanding of the true cost of living, and the importance of managing and paying down debt. Experiencing these scenarios in a controlled, interactive environment helps students build practical financial knowledge they may not otherwise gain.

High Point FCU is excited to offer Bite of Reality to high schools throughout its expanded field of membership, which includes all of Allegany, Cattaraugus, McKean, and Potter counties. For more information or to schedule Bite of Reality at your school, email Marketing@highpointfcu.com or call (716) 372-6607.

A New Year, A Fresh Start: Financial Goals Made Simple

The start of a new year is more than just flipping the calendar, it’s a chance to reset, refocus, and move forward with confidence. At High Point FCU, we believe the new year is the perfect time to check in on your financial goals and make small changes that can lead to big wins over time.

Whether you’re planning for the year ahead or simply looking for better financial habits, we’re here to help every step of the way.

Reflect Before You Reset

Before setting new goals, take a moment to look back. What worked for you financially last year? What felt challenging? Reflection helps you build realistic goals instead of overwhelming resolutions.

Even small wins, like building a little savings or paying down one bill, are worth celebrating. Progress is progress.

Set Realistic, Meaningful Goals

Instead of broad resolutions like “save more” or “spend less,” try setting clear, achievable goals:

- Build an emergency fund, even if it’s just a few dollars at a time

- Pay down high-interest debt

- Improve your credit score

- Save for a vacation, education, or a major purchase

Breaking goals into smaller steps makes them easier to stick with, and easier to celebrate when you reach them.

Make Saving Automatic

One of the simplest ways to stay on track is to make saving automatic. Setting up recurring transfers to your savings account can help you stay consistent without thinking about it each month.

Start the Year With a Financial Checkup

The new year is a great time to review your budget, loans, and savings. Ask yourself:

- Am I paying more interest than I need to?

- Do my accounts still fit my needs?

- Could I benefit from refinancing or consolidating?

Our team is always happy to help members review their finances and explore options that support their goals.

Let’s Make This Your Year

You don’t have to do it alone. Whether your goal is to save, borrow smarter, or simply feel more confident about your finances, High Point FCU is here to support you throughout the year.

Stop by a branch, explore our digital tools, or reach out to our team, we’d love to help you turn this fresh start into lasting financial confidence. Here’s to a new year full of opportunity, growth, and smart financial choices.

High Point FCU Donates $11,000 to Local Food Pantries

High Point FCU continued its commitment to fighting food insecurity this year by donating a total of $11,000 to support local food pantries throughout its field of membership. This annual contribution reflects the credit union’s dedication to strengthening the communities it serves and living out the credit union philosophy of people helping people.

This year’s donations supported the following food pantries: Olean Food Pantry, Creekside Chapel, Portville Community Food Pantry, Harvest Field Outreach Center, CAC Food Pantry, Salvation Army of Bradford Food Pantry, Hinsdale Ischua Food Pantry, Little Valley Food Pantry, Duke Center UMC Food Pantry, and Bolivar Food Pantry. Three of these organizations—Little Valley Food Pantry, Duke Center UMC Food Pantry, and Bolivar Food Pantry—were added this year. Each food pantry received a $1,000 donation. In addition, High Point FCU employees held a “Casual for a Cause” fundraiser, raising additional funds so that every food pantry also received an extra $100, for a total of $1,100 per pantry.

“Giving back is a core part of who we are,” said Rich Yeager, President & CEO of High Point FCU. “We’re proud to expand our support this year and stand alongside the organizations working to address food insecurity in our communities.” High Point FCU is the second largest credit union in Western New York, with assets of over $400 million. The credit union serves more than 20,000 members through four branch locations: 1201 Wayne Street in Olean, 180 West Main Street in Allegany, 160 South Main Street in Portville, and 1035 East Main Street in Bradford, PA.

Your Guide to Safe Online Shopping for Black Friday & Cyber Monday

Simple steps to avoid the scams you’re most likely to see this year.

Black Friday and Cyber Monday bring great deals, but they also bring a spike in online scams. Before you shop, here are the top holiday scams to watch out for and how to protect your information.

1. Fake Retail Websites

Scammers build look-alike sites that mimic popular stores. They use the same colors, similar logos, almost identical URLs.

How to stay safe:

- Look for https:// and the padlock icon

- Double-check the spelling of the URL

- When in doubt, type the retailer’s name into your browser yourself

2. Phishing Emails & “Exclusive Deal” Texts

You’ll see tons of promotions this time of year and scammers rely on that. Fake emails and texts may claim:

- “Your order couldn’t be delivered”

- “Your account has been locked”

- “Click here to claim your exclusive deal”

How to stay safe:

Don’t click links. Go directly to the retailer’s website or app to verify.

3. Fake Shipping Notifications

After making real purchases, members often fall for fake tracking updates. These messages link to malware or ask for personal information.

How to stay safe:

Track your packages only through official retailer websites.

4. Social Media Marketplace Scams

Posts offering hard-to-find gifts, game consoles, or “last minute deals” for unbelievably low prices are often scams.

Red flags:

- Seller wants payment through cash apps

- No reviews or very new account

- Price is dramatically lower than anywhere else

5. Gift Card Scams

Scammers will ask you to pay for items or fees using gift cards, or they sell discounted cards that don’t actually work.

How to stay safe:

Never use gift cards as payment and buy them only from trusted retailers in person.

Quick Safety Tips

- Use your credit union card for added fraud protection

- Enable account alerts in online or mobile banking

- Avoid shopping on public Wi-Fi

- Trust your gut! If a deal seems off, skip it

Shop Confidently This Holiday Season

With a few precautions, you can enjoy big savings without the stress of scams. If you notice unusual activity or suspect fraud, contact High Point FCU right away, we’re here to help.

Beware the Financial Frights: 5 Spooky Scams That Could Haunt Your Wallet

It’s that time of year again, jack-o’-lanterns glow, shadows creep a little longer, and the air is filled with spooky fun. But while you’re carving pumpkins and planning costumes, don’t forget: some monsters don’t hide under the bed… they lurk in your inbox.

At High Point FCU, we’re here to protect your finances from the real Halloween horrors, fraud and scams. So, grab your flashlight and follow us into the haunted woods of fraud prevention.

1. The Phishing Phantom

Lurks in: Emails, text messages, and phone calls.

Says things like:

“There’s a problem with your account. Click this link to verify your info now!”

This classic monster disguises itself as someone you trust; your bank, a delivery service, or even your grandma (sorry, Nana). If you click the wrong link, it could drain your account faster than a vampire at a blood bank.

How to fight it:

Never click on suspicious links. If in doubt, call us directly using the number on your debit card or our website.

2. The Zombie Debt Collector

Rises from: “Old” debts you don’t remember owing.

Wants: Personal information and payment—now!

Zombie debt collectors will try to scare you into paying fake or expired debts. They use urgency and fear to get you to give up personal info or send money without verifying the claim.

How to fight it:

Ask for proof of the debt in writing. Real collectors must provide it. And if you’re unsure, reach out to our team.

3. The Loan Witch’s Curse

Disguised as: “Too good to be true” loan or grant offers.

Promises: Fast cash, no credit check, and instant approval.

These dark sorcerers prey on those in need, luring victims into giving up banking info or paying “fees” for money that never arrives.

How to fight it:

If it sounds magical, it’s probably a trick. Only apply for loans through trusted institutions (like us!).

4. The Web of Identity Theft

Casts its net via: Data breaches, stolen mail, or careless clicks.

Goal: Steal your name, your money, and your peace of mind.

Once your identity is stolen, fraudsters can open accounts in your name, rack up debt, or file false tax returns.

How to fight it:

Shred sensitive documents, use strong passwords, and check your credit report regularly. And sign up for account alerts with us to catch suspicious activity early.

5. The Ghost Purchase

Haunts your account with: Unknown charges.

Often caused by: Stored card info on hacked websites or subscriptions you forgot about.

You might not even notice it at first, a small $1.99 charge here, $5.99 there, but ghosts can add up quickly.

How to fight it:

Monitor your account regularly. If something looks off, report it immediately. We can help you cancel your card and investigate the charge.

Don’t Be Afraid—We’re Here to Help!

The world of finance doesn’t have to be scary. At High Point FCU, we work year-round (not just Halloween) to keep your accounts safe, and your money protected.

If you ever suspect a scam, reach out to us. And remember the only thing you should be scared of this October is running out of candy.

Happy Halloween from your friends at High Point FCU! Stay safe, smart, and spooky!

Football Season Is Back and So Are Sports Betting Scams

What You Need to Know to Protect Your Wallet This Season

Football is back, and so is the excitement that comes with game days, fantasy leagues, and sports betting. But as more people place bets online, scammers are getting in on the action too. They’re targeting fans with schemes designed to steal money and personal information.

At High Point FCU, we want to help you enjoy the season without falling victim to fraud. Here’s what to watch out for, and how to stay protected.

Common Sports Betting Scams to Watch Out For

1. Fake Betting Apps and Websites

Fraudsters are creating realistic-looking websites and mobile apps that mimic legitimate sportsbooks. These sites often disappear once they’ve collected deposits, leaving users with no way to recover their money.

2. Social Media Tipster Scams

Beware of “insider” betting advice or paid picks from self-proclaimed experts on social media. Many of these accounts are fake, and once they receive payment, they vanish or push you toward fraudulent betting sites.

3. Phishing Emails and Texts

Scammers may send fake emails or texts claiming you’ve won a bet or need to verify your account. These messages often contain links designed to steal your login credentials or financial information.

4. Crypto-Only Betting Platforms

Some unregulated sites ask users to deposit cryptocurrency to place bets. These transactions are difficult to trace, and if the platform is a scam, recovering your funds is nearly impossible.

5. Impersonation Scams

Scammers may pose as customer service agents from popular betting apps, requesting personal information or payment to resolve a fake issue. Legitimate companies will never ask for sensitive data via text, direct message, or unexpected phone calls.

How to Bet Safely This Season

If you choose to participate in sports betting, it’s important to take precautions:

Use Licensed and Regulated Platforms

Always use sports betting sites that are legal in your state. Most state gaming commissions have lists of approved operators.

Avoid Untraceable Payments

Never send money using cryptocurrency, wire transfers, gift cards, or peer-to-peer apps unless you’re confident in the platform’s legitimacy and consumer protections.

Enable Account Alerts

Use your credit union’s mobile app or online banking tools to receive real-time alerts about purchases or suspicious activity.

Don’t Share Personal Information

Never provide your debit card PIN, online banking credentials, or Social Security number to someone claiming to be from a betting site or financial institution.

Use Strong Passwords and Two-Factor Authentication

Secure your devices and online accounts with strong passwords and two-factor authentication whenever possible.

We’re Here to Help

If you believe your information or account has been compromised, contact High Point FCU immediately. Our team can help you secure your accounts and guide you through the necessary steps to report fraud.

Scammers are always looking for new ways to take advantage, but with awareness and the right precautions, you can stay one step ahead.

Need help or have questions?

Stop by any of our branches, call us at 800-854-6052, or connect with us online for more information.

Stay safe and enjoy the football season!

What I Wish I Learned in School About Money Management 8 of 12: The Basics of Investing

Everyone dreams of becoming an investor but taking that first step into the market can feel overwhelming. Where should you begin? Which investments align with your goals?

So many questions, and we’ve got answers! Here’s what you need to know about investing to get started.

What is investing?

At its core, investing means putting your money into something with the expectation that it will grow in value over time. Investments can take many forms, including:

- Stocks-shares of ownership in a company.

- Bonds-loans you give to governments or corporations in exchange for interest.

- Mutual funds-pools of money from many investors used to buy a mix of stocks and bonds.

- Exchange-traded funds (ETFs)-similar to mutual funds but traded like individual stocks.

- Commodities-like gold or oil.

- Real estate-whether commercial or residential

Why invest?

Investing is crucial for long-term financial growth. Here’s why:

- Beat inflation. Investing helps your money grow at a rate that can outpace inflation.

- Build wealth. Consistent investing — even in small amounts — can add up over time thanks to compound interest, where you earn returns on your original investment and the returns you’ve earned.

- Reach financial goals. Whether you’re saving for retirement, a home or your child’s education, investing can help you get there faster than by saving alone.

Types of investments: the big three

- Stocks. When you buy a stock, you’re buying a piece of a company. If the company performs well, the stock’s value may rise, and you will likely get dividends, or a share of the company’s profits. Stocks can offer high returns, but they come with higher risk.

- Bonds. Bonds are generally more stable. When you buy a bond, you’re essentially lending money to a company or the government. In return, they promise to pay you back with interest.

- Mutual funds and ETFs. These are collections of investments managed by professionals (mutual funds) or following an index (ETFs). They offer diversification, which spreads out your risk by investing in several companies or sectors at once.

Risk and reward: finding the balance

Every investment carries risk, which means you can lose money. Generally, the higher the potential reward, the greater the risk. Your risk tolerance depends on factors like your age, financial goals, time horizon (when you’ll need the money) and your personal comfort with market fluctuations.

The power of compound interest

One of the most powerful forces in investing is compound interest. Let’s say you invest $1,000 and earn a 7% annual return. After one year, you’ll have $1,070. The next year, you earn interest on $1,070 — not just your original $1,000. Over time, that snowball effect can lead to massive growth.

Getting started

Here’s how to jump into the world of investing in five easy steps:

- Clarify your goals.

- Build an emergency fund first with three to six months’ worth of expenses saved.

- Start with tax-advantaged accounts, like a 401(k), IRA or Roth IRA.

- Choose a platform. You can invest through a brokerage account like Fidelity, or a robo-advisor like Betterment.

- Start small and stay consistent — even $50 a month adds up.

Investing tips for beginners

- Diversify. Spread your investments across different asset classes and markets.

- Think long-term. Expect fluctuations in the market and don’t panic over short-term drops. They rarely affect your overall net gain.

- Avoid trying to time the market. No one can predict exactly when to buy or sell. Time in the market usually beats timing the market.

- Stay educated. Read books, follow financial blogs and/or listen to podcasts on investing to deepen your understanding.

Start now, stay steady and watch your money grow.

Common Summer Scams and How to Avoid Them

Don’t get scammed this summer! Here are some of the most common summer scams and how to avoid them.

Travel scams

In these scams, fraudsters target vacationers with offers that are too good to be true. They’ll promote bogus travel sites with incredibly low prices on rentals, but when the victim travels to the alleged rental, they’ll find it doesn’t exist.

Red flags:

- “Free vacation” offers

- Ridiculously low-priced getaways

Stay safe: Only book your vacations through reputable travel sites and platforms. Before reserving, verify the property address online and run the photos through a reverse-image search. Pay via credit card for purchase protection.

Online shopping scams

Here, scammers create copycat shopping websites or fake social media stores selling seasonal gear at huge discounts They may lure you with aggressive email campaigns, fake security alerts and/or spoofed “order confirmation” messages.

Red flags:

- URLs with spelling errors and typos

- Emails that use urgent or threatening language

- “Verification” requests for account details you didn’t initiate

Stay safe: Only shop trusted sellers and platforms. Check for a padlock symbol and review the URL’s spelling of each landing page. Never pay by wire transfer or gift card when making a purchase. If you get an unexpected package notification or account alert, don’t click any links; instead log into your account directly or call the company using a verified number.

Event ticket scams

Concerts, sports games and festivals are summer staples, and scammers know it. Fake or counterfeit tickets are sold on shady sites and through social media posts, with fraud sales peaking in the summer.

Red flags:

- Unsolicited offers for tickets

- Online listings for extra “Hot Concert” tickets for a fraction of face value

- Requests to pay by cash or bank transfer

Stay safe: Only buy tickets from the venue box office, official promoter or verified resale sites. Use a credit card to pay, if possible.

Door-to-door scams

In these scams, fraudsters knock on doors and offer various home repairs on the spot. They’ll pressure the target with scare tactics like, “Our crew is leaving town tomorrow” or claim to have extra materials “left over.”

Red flags:

- “Contractors” without proper licensing or permits

- Door-to-door workers offering super-cheap work

Stay safe: Verify credentials before you hand over your personal info, cash or credit card. Ask for references before hiring and get a complete written estimate of the cost.

If you’ve been scammed

If you believe you’ve been scammed, take action quickly. Contact your credit union or credit card company to report any fraudulent charges and request a reversal. If you paid via a wire transfer or money app, notify the wire company and if gift cards were used, contact the card issuer to explain the fraud. Change any passwords that may have been compromised.

Next, file a report with the FTC and let local law enforcement agencies know about the scam. If you shared sensitive information, visit IdentityTheft.gov for step-by-step guidance.

Stay safe!

What I Wish I Learned in School: How to Manage Debt

Carrying ongoing debt can bring many challenges. The person is often stuck paying high interest rates. This, in turn, can prompt the debtor to only pay the minimum amount due each month. And that means making little headway on the actual balance. As time passes, they’ll keep acquiring new debt and keep falling deeper into the trap.

The good news is, it doesn’t have to be this way. With the right tools and information, you can learn to manage, and ultimately, eliminate your debt.

Here are nine steps for managing your debt and paying it down.

1. Organize your debt

First, list all your debts. Include credit cards, student loans, auto loans and any other outstanding balance you may carry. For each debt, note the following:

- Total amount owed

- Interest rate

- Minimum monthly payment

- Due date of monthly payment

Tally up your total debt monthly payments. Then, list your debts in order of interest rates, and then in order of outstanding balances.

2. Create a realistic budget

Track your income and expenses for several months. Then, set aside a reasonable amount for each spending category, ensuring you can adequately cover all of your monthly expenses. Finally, review your spending and look for ways you can increase your income and/or trim your expenses in any manner. Allocate these extra funds toward your debt payments.

3. Choose your debt payoff strategy

You have two primary choices here:

- The avalanche method. Here, you’ll start with the debt that has the highest interest rate or highest balance, and maximize payments toward paying it off, then move on to the next until you’re debt-free.

- The snowball method. In this method, you’ll pay off the smallest debt first, and then work through the rest in ascending order.

Review each strategy carefully and choose the one that best aligns with your lifestyle.

4. Consider debt consolidation

If you’re dealing with a large amount of debt, you may want to consider debt consolidation. This involves combining multiple debts into a single loan with a lower interest rate. Doing so will simplify debt management by giving you just one monthly payment to manage, and can potentially lower overall interest paid, too.

5. Avoid accumulating additional debt

Limit the use of credit cards and refrain from financing new purchases while working on paying off debt. It may be helpful to destroy your credit cards and have your personal devices “forget” your credit card information so you don’t spend mindlessly.

6. Seek professional advice

If managing debt becomes overwhelming, consider consulting a financial advisor or credit counseling service. It’s important to verify any service you use by checking for an online presence, reading customer reviews, demanding complete transparency and being wary of any service that demands upfront payment and/or promises outrageous results.

7. Monitor your credit

It’s wise to review your credit usage on a regular basis, and this is especially relevant when you’re working toward paying down debt. You can obtain free credit reports once a year from each of the three major credit bureaus and check your score on sites like CreditKarma. It’s also important to review your monthly credit card statements for fraud.

8. Build an emergency fund

Having an emergency fund can prevent the need to incur additional debt during unforeseen circumstances. Aim for a fund amounting to three to six months’ worth of living expenses.

9. Stay committed and patient

Celebrate small victories along the way to stay motivated. Consistency and perseverance are the keys to achieving financial freedom.

Follow these tips to learn how to manage and pay down your debt for good.

Don’t Get Hooked: How to Recognize and Avoid Phishing Scams

Don’t get caught in a phishing scam! Here’s how to stay safe.

What is phishing?

Phishing is a cybercrime where scammers use deceptive messages to steal victims’ personal information. These messages can impersonate well-known companies, government agencies, celebrities or even people the victim knows. The goal is to create a sense of urgency, fear or curiosity, which often dupes people into clicking a malicious link or providing confidential details.

There are several ways phishing scams play out, including fake emails or texts from banks or credit unions, phone calls posing as tech support, messages pretending to be from a delivery service with links to “track your package” and fraudulent text alerts about unusual activity on your accounts.

Let’s take a closer look at the three most common variations of phishing scams.

1. Email phishing

Email phishing is the most common type of phishing scam. In this ruse, criminals send fraudulent emails that look trustworthy and encourage you to click a link or download an attachment. For example, an email that appears to be from your credit union or bank may instruct you to verify your account by clicking a link and logging in. Unfortunately, the link leads to a fake website where your credentials are stolen.

Red flags to watch for:

- Urgent language

- Generic greetings

- Suspicious email addresses

- Spelling and grammar errors

- Unexpected attachments

2. Vishing (voice phishing)

In vishing scams, scammers call victims and pretend to be legit representatives, often pressuring the victim into providing sensitive information. For example, a scammer calls, claiming to be from your credit union’s fraud department. They’ll tell you your account has been compromised and will ask for your PIN to secure it.

Red flags to watch for:

- Unsolicited calls

- Requests for personal info

- High-pressure tactics

- Spoofed numbers

3. Smishing (text phishing)

Smishing uses text messages to trick victims into clicking on malicious links or sharing private information. For example, a text claims there’s a problem with your delivery and asks you to click a link to update your shipping details. The link leads to a fraudulent site.

Red flags to watch for:

- Unexpected texts

- Links to unfamiliar websites

- Grammatical errors

- Too-good-to-be-true offers

How to protect yourself

Here’s how to defend yourself from a phishing attack:

- Think before you click. Don’t click on links or download attachments from unknown sources.

- Verify the source. Contact the organization directly using official contact information, not what’s provided in the message.

- Enable multi-factor authentication (MFA). Add an extra layer of security to your accounts.

- Inspect URLs. Before choosing to click or not, hover over links to check for inconsistencies.

- Avoid sharing sensitive information. Legitimate organizations won’t ask for passwords or personal details by email, text or phone.

- Use antivirus software. Keep your devices protected and ensure your software is updated.

- Educate yourself. Learn to recognize phishing attempts and stay informed about the latest scams.

Stay safe!

First-Time Home-Buyer’s Checklist

Buying your first home is exciting and challenging. To make it easy for you, we’ve put together a comprehensive checklist to guide you through the home-buying process.

1. Get your finances in order

Before you can think about buying a house, ensure your finances are up to par. Several months before you start your search, review the following:

- Your income. You’ll need to demonstrate a consistent and reliable income source to lenders.

- Credit score. Your credit score significantly influences your mortgage eligibility and interest rates.

- Debt-to-income (DTI) ratio. Calculate your DTI by dividing your monthly debt payments by your gross monthly income.

It’s also a good idea to start gathering the documents you’ll need:

- Two years’ worth of W-2s

- Profit & loss statement, if self-employed

- Pensions and Social Security check stubs

- Proof of child support payments

- Copies of alimony checks

- Statements for all checking and savings accounts

- Car loan information

2. Determine your budget

Calculate your current monthly expenses by listing all your recurring bills excluding your current rent payments. Include debts, groceries and entertainment expenses and then see how much room you have left in your budget for a monthly mortgage payment. Be sure to budget for ongoing household expenses, too.

3. Prepare your down payment

Next, be sure you have the funds prepared for a down payment. While a 20% down payment is traditional, there are various loan programs that allow for lower percentages. However, smaller down payments might require private mortgage insurance (PMI).

4. Assemble your real estate team

Look for a real estate agent who can provide market insights, negotiate on your behalf and guide you through the buying process. You’ll also need a mortgage broker and/or lender to help navigate various loan options and find the best rates. In some states, you’ll need a real estate attorney as well.

5. Get pre-approved

A mortgage pre-approval, which indicates the loan amount you’re approved for, strengthens your position as a serious buyer. Present your prepared documents to your chosen mortgage broker or lender and let them know how much you plan to spend on your new home. If everything is in order, you should receive your pre-approval letter within a few days.

6. Start house hunting

You’re ready to start your search!

Identify your must-haves, which can be deal-breakers, and the things you’d like to have in your new home. Consider factors like location, size and amenities. Explore different neighborhoods, attend open houses and monitor market trends.

7. Make an offer

Next, work with your agent to determine a base offer and have the home inspected to identify potential issues, from structural problems to necessary repairs. The home will also need to be professionally appraised at this time.

9. Secure financing

During this time, you’ll also need to finalize your financing. Be sure to submit all required documents to your lender in a timely manner. You’ll also need to decide when to lock your interest rate, considering market conditions. Finally, review the loan estimates to ensure you understand all costs associated with your mortgage.

10. Prepare for closing

As the closing date approaches, you’ll need to perform some final tasks:

- Final walk-through. Inspect the property to ensure it’s in the agreed-upon condition.

- Look over the closing document,, which outlines your loan terms, monthly payments and closing costs.

- Arrange funds for closing.

11. Close on your new home

You’re ready for the final step in the purchase of your new home: the closing! Be prepared to sign multiple documents, including the deed of trust, promissory note and closing disclosure. Once all documents are signed and funds are transferred, you’ll receive the keys to your new home.

12. Post-closing tasks

After the closing, you’ll need to transfer or establish accounts for electricity, water, internet and other essential services. Decorate and refresh the home according to your taste. Now all that’s left to do is pack up and move in!

Follow this checklist to navigate the homebuying process with ease.

What I Wish I Learned in School 6 of 12: Avoiding Lifestyle Creep

Most people assume that they’ll start saving and investing a lot more money if their income were to increase. But, what actually happens after that raise is that their savings percent doesn’t budge and they have no idea where the extra money is going. This is usually due to lifestyle creep. Let’s take a look at this phenomenon, why it happens and how you can avoid it to maintain a life of financial fitness.

What is lifestyle creep?

Lifestyle creep, also known as lifestyle inflation, is when people’s monthly expenses increase along with their income. Unchecked lifestyle creep can ruin long-term financial goals, leaving people in a cycle where higher earnings don’t translate to increased savings or financial security.

Recognizing the signs

Here are some signs that you may be caught in lifestyle creep:

- Stagnant savings. Despite earning more, your savings or investment accounts aren’t growing.

- Increased debt. You’re consistently taking on more debt to finance a more lavish lifestyle.

- Frequent upgrades. You’re constantly upgrading things even though the current model is fully functional.

- Tight budget. You’re always running low on money by the end of the month despite an increase in income.

Strategies to avoid lifestyle creep

Follow these tips to stay financially fit under any circumstance:

- Establish clear financial goals. Long- and short-term financial goals will help keep you on track.

- Create and stick to a budget. Develop a detailed monthly budget that assigns a dollar amount for each spending category. Review and adjust your budget regularly.

- Limit your revolving credit. It’s best to keep your credit limit down, even with an increase in your income.

- Automate savings and investments. Set up automatic monthly transfers to your savings account.

- Mindful spending. To avoid buyer’s remorse, implement a waiting period for significant purchases, such as a 48-hour rule, to determine if the expense is really necessary.

- Regular financial audits. It’s a good idea to review your financial statements on a regular basis to see where you may be overspending.

- Resist social pressures. Instead of trying to match or outdo online personalities, create your own personal and financial goals, a realistic plan for achieving them and then go and get ‘em!

- Live below your means. Even with a higher income, it’s best to spend less than you earn.

Use these tips for active steps you can take to prevent and avoid lifestyle inflation.

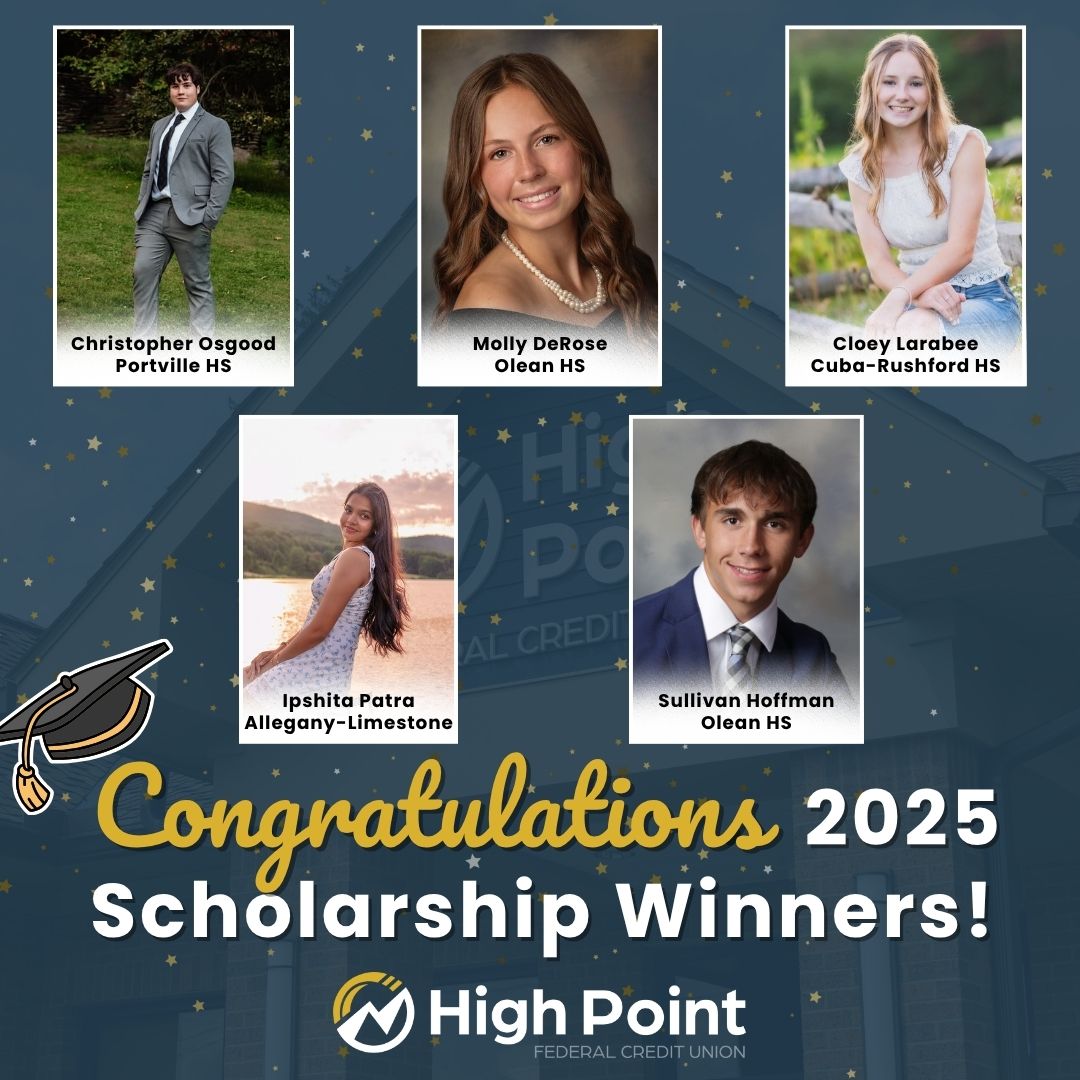

High Point Federal Credit Union Awards Scholarships to Collegebound Seniors

Olean, NY – High Point Federal Credit Union has granted $2,500 in college scholarships to five high school seniors to assist them in funding their higher education.

The recipients, who are members of High Point FCU, were selected based on their exceptional academic and extracurricular accomplishments.

Richard Yeager, CEO, spoke about how meaningful it is each year to meet the scholarship recipients and celebrate their hard work and potential. He shared that these moments truly reflect the credit union philosophy of ‘people helping people’, a reminder of the impact that comes from supporting one another and investing in our communities.

The high school seniors who were honored with the scholarships include Sullivan Hoffman and Molly DeRose from Olean High School, Ipshita Patra from Allegany-Limestone High School, Cloey Larabee from Cuba-Rushford High School, and Christopher Osgood from Portville High School.

High Point FCU is the second largest credit union in Western New York, with assets over $400 million. The credit union currently serves over 21,000 members with four locations, 1201 Wayne Street and 206 North Clark Street in Olean, 180 West Main Street in Allegany, 160 S. Main Street in Portville, and 1035 East Main Street in Bradford.

What’s the Difference Between a Home Equity Line of Credit and a Home Equity Loan?

If you’re looking to tap into your home’s equity, you have two great choices in a Home Equity Line of Credit (HELOC) and a Home Equity Loan (HEL). Let’s take a look at these two options, the key features of each and factors to consider before making a decision.

How are HELOCs and home equity loans used?

Although they are structured differently, HELOCs and home equity loans are generally used for similar purposes:

- Home renovations

- Debt consolidation

- Emergency expenses

- Large purchases

- Business launch or growth

What Is a Home Equity Line of Credit (HELOC)?

A HELOC features a revolving line of credit that the homeowner can draw from as needed. The borrower can use funds up to a predetermined limit and repay them over time, often only paying interest on the borrowed amount.

Key features of HELOCs:

- Revolving credit. Homeowners have access to a line of credit that can be drawn upon repeatedly during the “draw period,” which tends to last five to 10 years.

- Variable interest rate. HELOCs often have variable rates, which means the interest rate can change based on market conditions. Because of this, monthly payments can fluctuate throughout the HELOC term.

- Flexible repayment. Borrowers have the flexibility to pay off the balance and then re-borrow funds during the draw period.

- Interest-only payments initially. Many HELOCs allow interest-only payments during the draw period, making initial payments lower.

What is a home equity loan?

A home equity loan is a loan that’s borrowed against your home’s equity. Your home’s equity is calculated as the difference between the current market value of the home and the outstanding balance on the mortgage.

Key features of home equity loans:

- Lump sum disbursement. Borrowers receive the full loan amount all at once.

- Fixed interest rate. Most home equity loans come with a fixed interest rate.

- Set repayment terms. The loan is repaid over a predetermined period, which typically ranges from five to 30 years.

- Predictable payments. Borrowers know exactly how much they’ll pay throughout the life of the loan, making budgeting for the loan easy.

Key differences between HELOCs and home equity loans

Understanding the differences between these two products is crucial for deciding which is right for you.

1. Disbursement of funds:

- HELOCs offer a revolving line of credit that can be drawn as needed. This makes them ideal for homeowners who don’t know exactly how much they need to borrow.

- Home equity loans provide a one-time lump sum, making them the perfect choice for borrowers who know exactly how much they want to borrow and need the funds right away.

2. Interest rate structure:

- HELOCs generally have a variable interest rate, which can fluctuate with market conditions. This can mean having a lower monthly payment at times, but it can also lead to rising payments.

- Home equity loans typically come with a fixed interest rate, which means there are no surprises throughout the life of the loan. This can mean significant savings for the borrower if interest rates rise, with the inverse occurring if rates drop.

3. Repayment terms:

- HELOCs feature flexible payment terms during the draw period. However, payments may vary once principal repayments begin.

- Home equity loans have a fixed repayment period with predictable monthly payments.

Whichever home equity product you decide on, you’re assured favorable interest rates, easy eligibility and the personalized service you’ve come to expect. Call, click or stop by today to learn more.

What I Wish I Learned in School 5 of 12: The Importance of an Emergency Fund

Everyone knows it’s important to create and stick to a budget, but many people neglect to plan for the unexpected. Without proper planning, any surprise life event can send you spiraling into long-term debt.

The best way to plan for these events is by building an emergency fund for just this purpose.

Let’s take a closer look at why an emergency fund is so important and how to begin building your own.

Why is an emergency fund essential?

- Financial security. Unexpected expenses can arise at any time. An emergency fund provides the financial buffer needed to handle these surprises without throwing off your financial stability.

- Debt prevention. Having savings set aside can help you avoid resorting to debt when the unexpected happens.

- Less stress. Knowing there’s a financial cushion in place to help you navigate almost any financial reality, can help you sleep better at night. In addition, when an emergency strikes, the fund can help alleviate the financial anxiety typical of uncertain times.

Common uses for an emergency fund

- Job loss. An emergency fund ensures you can manage essential expenses while seeking new employment.

- Medical emergencies. Savings can help cover deductibles, treatments or medications that are not covered by insurance.

- Home or car repairs. An emergency fund allows for timely car and home repairs without financial strain.

How much should you save?

Financial experts typically recommend setting aside three to six months’ worth of living expenses in an emergency fund. However, the exact amount should be tweaked to individual circumstances.

Building your fund

Here are some tips for getting started on building your emergency fund today.

- Assess your expenses.

- Set realistic goals.

- Automate your savings with a monthly transfer to your savings account.

- Trim your spending.

- Use windfalls to boost your emergency fund.

Where to keep your emergency fund

Accessibility and safety are crucial when choosing where to store your emergency savings. High-yield savings accounts are often recommended due to their balance of liquidity and interest earnings. These accounts allow quick access to funds when needed while offering better returns than standard savings accounts.

Maintaining and replenishing your fund

It’s important that you use your emergency fund only for genuine emergencies. If you need to withdraw from it, prioritize replenishing the fund as soon as possible.

An emergency fund is more than just a financial safety net; it’s a foundation for long-term financial well-being. Build yours today!

What I Wish I Learned in School 4 of 12: Taxes Demystified

Taxes can seem daunting, especially when you’re just starting out. Here’s everything about taxes you wish you’d learned in school.

1. Taxes are inevitable

The first thing to know is that taxes are a part of life. Whether you’re earning a paycheck, running a business or investing, you’ll interact with the tax system. The key is to be informed and organized.

2. Your paycheck doesn’t show the whole picture

If you’ve ever wondered why your take-home pay is less than your salary, taxes are the answer. Employers withhold income taxes, Social Security and Medicare from your paycheck. This is called “pay-as-you-go” taxation.

Review your W-4 form when you start a new job or when your financial situation changes. This form determines how much federal income tax your employer withholds. Claiming too many allowances could lead to a big tax bill in April, while too few may mean you’re overpaying.

3. Tax deductions and credits are your friends

One of the most confusing aspects of taxes is the difference between deductions and credits:

- Deductions lower your taxable income, which reduces the amount of tax you owe.

- Credits are even better because they directly reduce the amount of tax you owe.

Learn which deductions and credits you qualify for.

4. Filing isn’t as scary as it seems

Gather all your important documents:

- W-2s from your employer(s)

- 1099s for freelance work or investment income

- Receipts for deductible expenses

- Records of charitable donations

Next, choose a filing method. You can use tax software or hire a professional.

5. Keeping records is crucial

The IRS recommends keeping tax-related documents for three years. This includes:

- Pay stubs

- Bank statements

- Tax returns

- Receipts for deductions

Keep these documents in a safe place for easy access.

6. Understand the difference between a refund and a bill

Getting a tax refund may feel like a bonus, but it means you paid more in taxes than you owed. On the flip side, owing taxes at the end of the year can be stressful. To avoid surprises, adjust your withholding or make estimated tax payments if you’re self-employed.

7. Retirement accounts offer tax advantages

It’s important to know how powerful retirement accounts are for saving on taxes. Contributions to traditional IRAs and 401(k)s are often tax-deductible, reducing your taxable income. Roth IRAs don’t offer an upfront deduction, but your withdrawals in retirement are tax-free.

Taking advantage of these accounts can help you build wealth while lowering your tax burden.

8. State taxes matter, too

Most states have income taxes, and each state has its own rules and rates. Research your state’s tax laws to avoid surprises and plan accordingly.

9. Deadlines are non-negotiable

The IRS tax filing deadline is typically April 15, but it may vary if on a weekend or holiday. Missing this deadline can result in penalties and interest on any taxes owed.

Use this guide to learn all about taxes.

6 Ways to Spring-Clean Your Savings

Time to get started on some spring cleaning! Remember to include your finances as part of your decluttering and tidying up. Well-organized money management can help you reach your saving goals. Here are six ways to spring clean your savings and make sure your financial goals are on track.

1. Organize your financial goals

Start by revisiting your financial goals. Have they changed since you last reviewed them? Refocusing your goals will help ensure your savings align with current needs and future aspirations.

2. Polish your savings accounts

Take a close look at your savings accounts. Evaluate the following:

- Interest rates. Consider switching to a high-yield savings account or a credit union account that’s offering better returns.

- Fees. Check for maintenance fees or minimum balance requirements. These can secretly erode your savings over time.

- Accessibility. Make sure you’re not keeping all your savings in accounts that are too easy to dip into.

If you’d like to change up your savings accounts, speak to an MSR at High Point FCU to learn which account may be better for your needs and goals.

3. Spruce up your budget

Give your budget a glow-up this spring. Here’s how:

- Track expenses. Review your spending habits and identify areas where you can cut back.

- Adjust categories. Tweak your categories to better reflect your current reality.

- Automate your savings. Set up automatic regular transfers from your checking account to your savings.

4. Clean up your subscriptions

Review your checking account statements or use a subscription-tracking app to identify recurring charges for services you no longer use. Canceling even a few subscriptions can free up some funds to give your savings a boost.

5. Make your emergency fund shine

No emergency fund? Or is your fund getting skimpy? Now’s the time to build it up. Aim for at least three to six months’ worth of living expenses to ensure you don’t need to dip into savings when the unexpected happens.

6. Dust off your debt

List your debts, including balances, interest rates and minimum payments. Then, choose a repayment strategy. You can go with the snowball method, in which you pay off the smallest debts first to build momentum, or with the avalanche method, in which you pay off the highest-interest debts first to save on interest.

As you declutter your home this spring, don’t forget to spruce up your savings, too! Use these tips to get started.