Blog

- What I Wish I Learned in School 6 of 12: Avoiding Lifestyle CreepMost people assume that they’ll start saving and investing a lot more money if their income were to increase. But, what actually happens after that raise is that their savings percent doesn’t budge and they have no idea where the… Read more: What I Wish I Learned in School 6 of 12: Avoiding Lifestyle Creep

- What I Wish I Learned in School 5 of 12: The Importance of an Emergency FundEveryone knows it’s important to create and stick to a budget, but many people neglect to plan for the unexpected. Without proper planning, any surprise life event can send you spiraling into long-term debt. The best way to plan for… Read more: What I Wish I Learned in School 5 of 12: The Importance of an Emergency Fund

- What I Wish I Learned in School 4 of 12: Taxes DemystifiedTaxes can seem daunting, especially when you’re just starting out. Here’s everything about taxes you wish you’d learned in school. 1. Taxes are inevitable The first thing to know is that taxes are a part of life. Whether you’re earning… Read more: What I Wish I Learned in School 4 of 12: Taxes Demystified

- What I Wish I Learned in School 3 of 12: Credit Card SmartsWhen it comes to life skills, managing credit cards is one of the most important lessons. But mastering the ins and outs of responsible credit card management can be the key to a lifetime of financial wellness. On the flipside,… Read more: What I Wish I Learned in School 3 of 12: Credit Card Smarts

- How to Set SMART Financial Goals (and Actually Reach Them!)Setting goals for your money might sound boring, but it’s like creating a game plan to get what you want and feel awesome while doing it. Whether you’re saving for new sneakers, a new phone or your future, using the… Read more: How to Set SMART Financial Goals (and Actually Reach Them!)

- Beware of AI Scams!From revolutionizing industries, like healthcare and finance, to replacing jobs in publishing and graphics, Artificial intelligence (AI) is changing the world. Unfortunately, scammers are also using AI to con victims out of their money and personal info. Here’s what you… Read more: Beware of AI Scams!

- What I Wish I Learned in School 2 of 12-Budgeting Basics: A Step-by-Step Guide to Taking Control of Your FinancesManaging your money doesn’t have to be hard! Here’s how to budget in seven simple steps. Step 1: Know your income Before you can plan your spending, identify exactly how much money is coming in. List all sources of income… Read more: What I Wish I Learned in School 2 of 12-Budgeting Basics: A Step-by-Step Guide to Taking Control of Your Finances

- Q&A: How Can I Stay Warm this Winter Without Breaking the Budget?The temperatures are dropping, and that means your heating costs are about to soar! The good news is: You can have a well-heated home and your budget, too. Here’s how: 1.Use a programmable thermostat Set your thermostat to lower temperatures… Read more: Q&A: How Can I Stay Warm this Winter Without Breaking the Budget?

- Scam Alert: QR Codes from Unexpected Packages You’ve just received a package from an unfamiliar sender addressed to you. Inside, there’s a note featuring a QR code instructing you to scan it for more information. Exercise caution, as this could be a scam aimed at stealing your… Read more: Scam Alert: QR Codes from Unexpected Packages

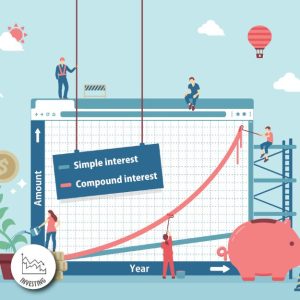

- What I Wish I Learned in School 1 of 12: Compound InterestIf there’s one financial concept that has the power to change lives, but is underappreciated, it’s compound interest. For most of us, compound interest wasn’t covered in school, leaving us to stumble upon its magic later in life. And it’s… Read more: What I Wish I Learned in School 1 of 12: Compound Interest

- Don’t Get Caught In a Paper Check Scam!Don’t get caught in a paper check scam! Here’s some info, and how you can stay safe. What is a paper check scam? There are several variations of paper check scams. The most common forms include: How to spot a… Read more: Don’t Get Caught In a Paper Check Scam!

- The Hidden Costs of Buying a HomeBuying a home is a big milestone, but there are many hidden costs that can quickly add up, catching many first-time homebuyers by surprise. Here are some of the hidden costs of buying a home. 1. Home inspection Cost: $300-$500… Read more: The Hidden Costs of Buying a Home

- Q&A: How Should I Fund my Holiday Expenses?Q: I’ve listed all my anticipated expenses for the holiday season and I’m ready to hide under my covers until January. There’s so much to buy and so little money! How can I pay for my holiday expenses? A: Yep, ‘tis the… Read more: Q&A: How Should I Fund my Holiday Expenses?

- Black Friday HacksBlack Friday is the bargain-hunter’s dream, but it’s a game that’s gotta be played right. Follow these hacks to score big during the biggest shopping day of the year. Many stores release Black Friday ads ahead of time. It allows… Read more: Black Friday Hacks

- How to Celebrate Thanksgiving on a BudgetThanksgiving isn’t cheap! With the costs of food, decor and travel, there are so many expenses to cover. With a bit of planning, though, you can enjoy a festive holiday without breaking the bank. Here’s how to save on Thanksgiving… Read more: How to Celebrate Thanksgiving on a Budget

- Don’t Get Caught in an Election ScamDemocracy is a privilege that’s upheld by the election process. But scammers are out to hijack this process and cause havoc throughout election season. Here are three scams to watch out for this time of year. Eleventh-hour campaign contributions This… Read more: Don’t Get Caught in an Election Scam

- Anatomy of a Car PaymentWhen you get a loan to buy a car, you’ll get a new set of keys — and a new monthly payment. It may have you wondering how this payment is determined and how it’s calculated. So many questions, and… Read more: Anatomy of a Car Payment

- Beware of Auto Repair ScamsUnless you’re an auto mechanic or self-professed expert on cars, you likely don’t know all there is about the inner workings of your car. This can make you vulnerable to falling for an auto repair scam, which can be challenging… Read more: Beware of Auto Repair Scams

- Beware Back to School ScamsWhether you’re a college student prepping for the fall semester, a high school student getting ready for a new school year or the parent of a student of any age, beware these trending back-to-school scams! The student tax scam In… Read more: Beware Back to School Scams

- The Anatomy of a Mortgage PaymentTrying to understand your mortgage payment can be like trying to decode a secret language. At the very least, you may be wondering what all the lingo means. No worries; we can help! Let’s take a look at the different… Read more: The Anatomy of a Mortgage Payment