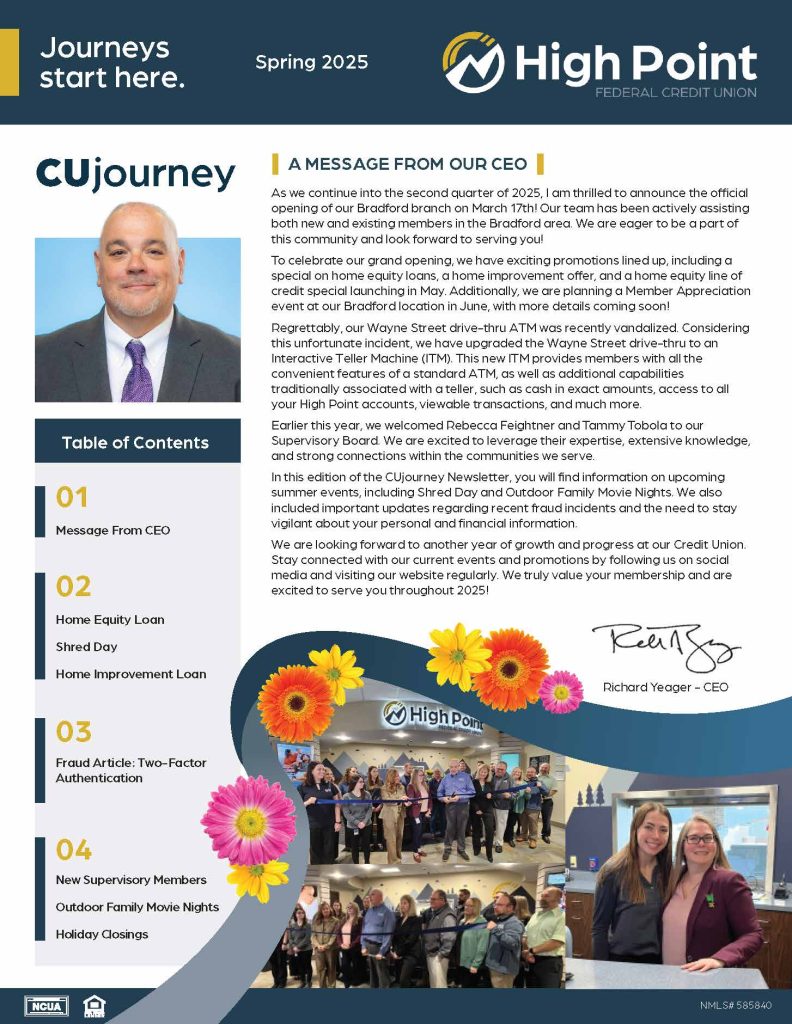

What’s the Difference Between a Home Equity Line of Credit and a Home Equity Loan?

If you’re looking to tap into your home’s equity, you have two great choices in a Home Equity Line of Credit (HELOC) and a Home Equity Loan (HEL). Let’s take a look at these two options, the key features of each and factors to consider before making a decision.

How are HELOCs and home equity loans used?

Although they are structured differently, HELOCs and home equity loans are generally used for similar purposes:

- Home renovations

- Debt consolidation

- Emergency expenses

- Large purchases

- Business launch or growth

What Is a Home Equity Line of Credit (HELOC)?

A HELOC features a revolving line of credit that the homeowner can draw from as needed. The borrower can use funds up to a predetermined limit and repay them over time, often only paying interest on the borrowed amount.

Key features of HELOCs:

- Revolving credit. Homeowners have access to a line of credit that can be drawn upon repeatedly during the “draw period,” which tends to last five to 10 years.

- Variable interest rate. HELOCs often have variable rates, which means the interest rate can change based on market conditions. Because of this, monthly payments can fluctuate throughout the HELOC term.

- Flexible repayment. Borrowers have the flexibility to pay off the balance and then re-borrow funds during the draw period.

- Interest-only payments initially. Many HELOCs allow interest-only payments during the draw period, making initial payments lower.

What is a home equity loan?

A home equity loan is a loan that’s borrowed against your home’s equity. Your home’s equity is calculated as the difference between the current market value of the home and the outstanding balance on the mortgage.

Key features of home equity loans:

- Lump sum disbursement. Borrowers receive the full loan amount all at once.

- Fixed interest rate. Most home equity loans come with a fixed interest rate.

- Set repayment terms. The loan is repaid over a predetermined period, which typically ranges from five to 30 years.

- Predictable payments. Borrowers know exactly how much they’ll pay throughout the life of the loan, making budgeting for the loan easy.

Key differences between HELOCs and home equity loans

Understanding the differences between these two products is crucial for deciding which is right for you.

1. Disbursement of funds:

- HELOCs offer a revolving line of credit that can be drawn as needed. This makes them ideal for homeowners who don’t know exactly how much they need to borrow.

- Home equity loans provide a one-time lump sum, making them the perfect choice for borrowers who know exactly how much they want to borrow and need the funds right away.

2. Interest rate structure:

- HELOCs generally have a variable interest rate, which can fluctuate with market conditions. This can mean having a lower monthly payment at times, but it can also lead to rising payments.

- Home equity loans typically come with a fixed interest rate, which means there are no surprises throughout the life of the loan. This can mean significant savings for the borrower if interest rates rise, with the inverse occurring if rates drop.

3. Repayment terms:

- HELOCs feature flexible payment terms during the draw period. However, payments may vary once principal repayments begin.

- Home equity loans have a fixed repayment period with predictable monthly payments.

Whichever home equity product you decide on, you’re assured favorable interest rates, easy eligibility and the personalized service you’ve come to expect. Call, click or stop by today to learn more.